Behavioural Science in Insurance Applications

The average person’s ability to collect information about a question, analyze the relevant facts, and reason to an objective conclusion is impressive, but not unlimited. When faced with questions involving large amounts of technical jargon or requiring complex calculations, most people will start to experience cognitive overload, feeling frustrated and overwhelmed. To cope with this overload, they will often resort to simpler ways of dealing with the question, such as skimming through it, giving the easiest answer, or trying to avoid the question altogether.

Behavioural science also points to external factors that can influence people’s decisions. In particular, social norms are a potent force in a range of situations. Social norms are a set of often unspoken traditions or expectations of a group or society. Violating these norms can lead to uncomfortable feelings of social stigma or anxiety, as people fear being judged for breaking from the group or being ostracised. As a result, there is an incentive to hide or downplay behaviour that is outside the social norm.

For life and health insurance underwriting, insights from behavioural science can be harnessed to improve the applicant’s experience, promote engagement, reduce dropout rates (where the application is discontinued), increase the quality of disclosure, and decrease misrepresentation.

Adding the applicant perspective

The understanding of human decision-making provided by behavioural science can inform the design of the life insurance application process. Historically, this process has been designed from the point of the view of the underwriter. An underwriter needs certain information about the applicant to analyze their case – information about their medical history, habits and behaviours, and current health. From the underwriter’s perspective, the simplest way to collect this information is to ask about it directly, in some sort of logical order, with a high degree of technical precision.

However, this way of looking at the process misses an important fact: there is another person involved in the application – the applicant themselves This person will approach the application with a different perspective. They may genuinely want to complete the application honestly and to the best of their ability, but they are also likely to be unfamiliar with medical jargon and be intimidated by long, complex forms. They may also be pressed for time, confused by the process itself, and nervous about being honest about certain aspects of their life.

If the application process does not address this applicant perspective, it can lead to misrepresentation and non-disclosure. Even applicants who are trying to be honest may make genuine mistakes if they do not understand aspects of the form. Many applicants will also find ways to justify their non-disclosure or under-disclosure to themselves so it does not seem to be truly dishonest.

Study design

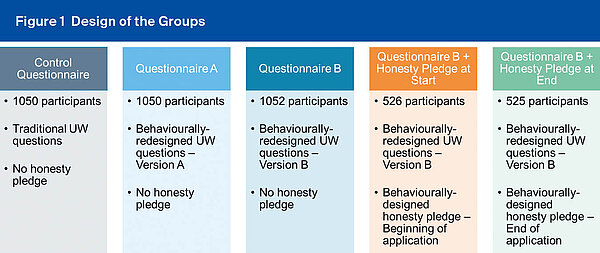

SCOR conducted an online experiment to test the potential of various behavioural science techniques as applied to the

design of a typical US life insurance application form.1

The 4200 participants recruited for this study were chosen to be representative of the US insurance market population based on age, gender, and education level. The participants were randomly assigned to one of several groups (see Figure 1). The control group was presented with a sample life insurance application form designed to mimic the format and wording of a traditional form currently in use in the US market. Participants in the next two groups were presented with one of two different forms (Questionnaires A and B) that had been redesigned using various behavioural

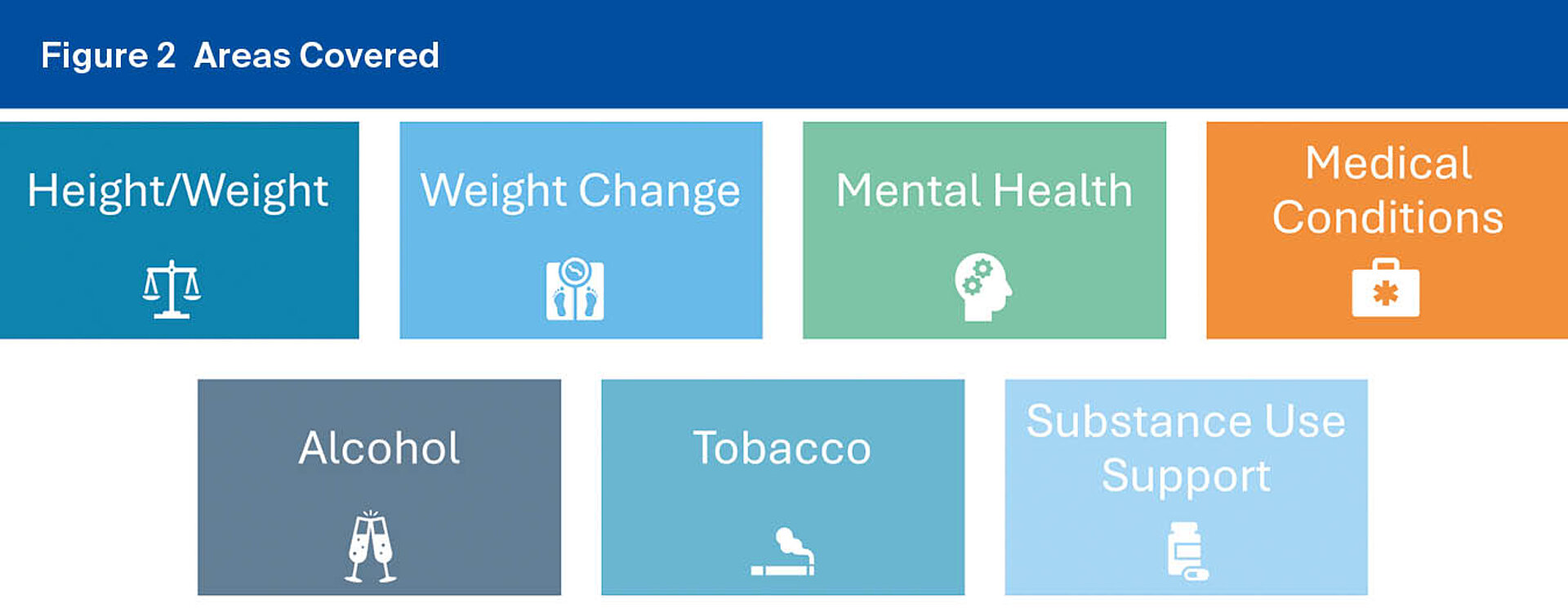

science techniques. Finally, some participants were assigned to receive Questionnaire B along with an honesty pledge at either the beginning or the end of the form. All of the forms presented to the participants asked about the same things, just in different ways (see Figure 2 below). Disclosure rates for each question were measured for each group, and these disclosure rates were then compared between the groups. The random assignment of the groups means that the differences between their outcomes are expected to be fairly small and of low magnitude. Therefore, any large differences between the disclosure rates can be assumed to be due to the differences in the wording and format of the forms.

Figure 2 Areas Covered

Finding #1: Asking one thing at a time can increase disclosure by reducing feelings of social stigma.

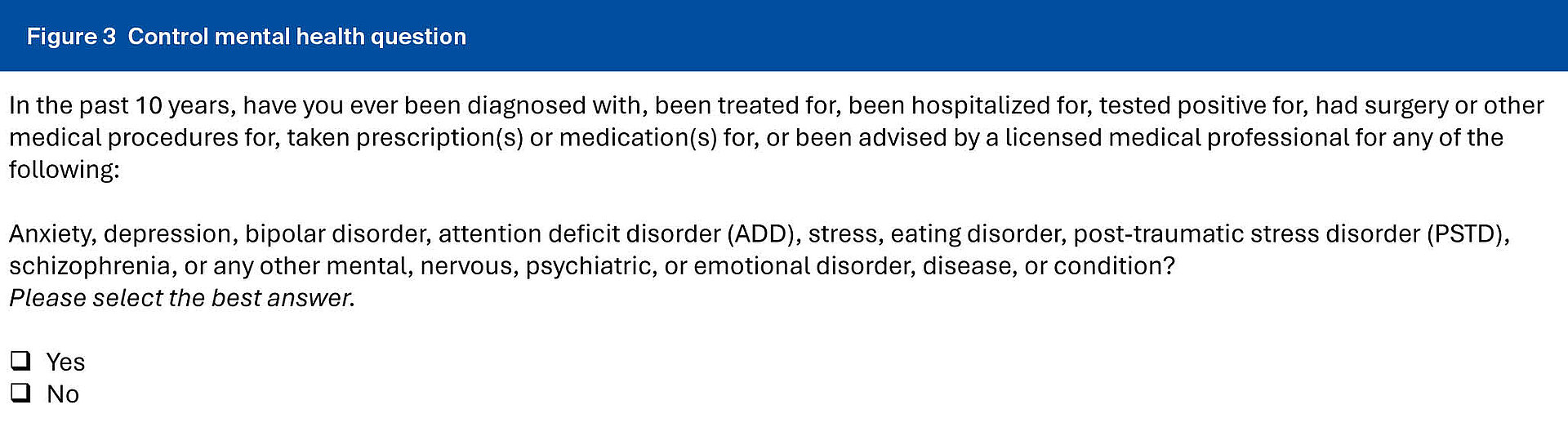

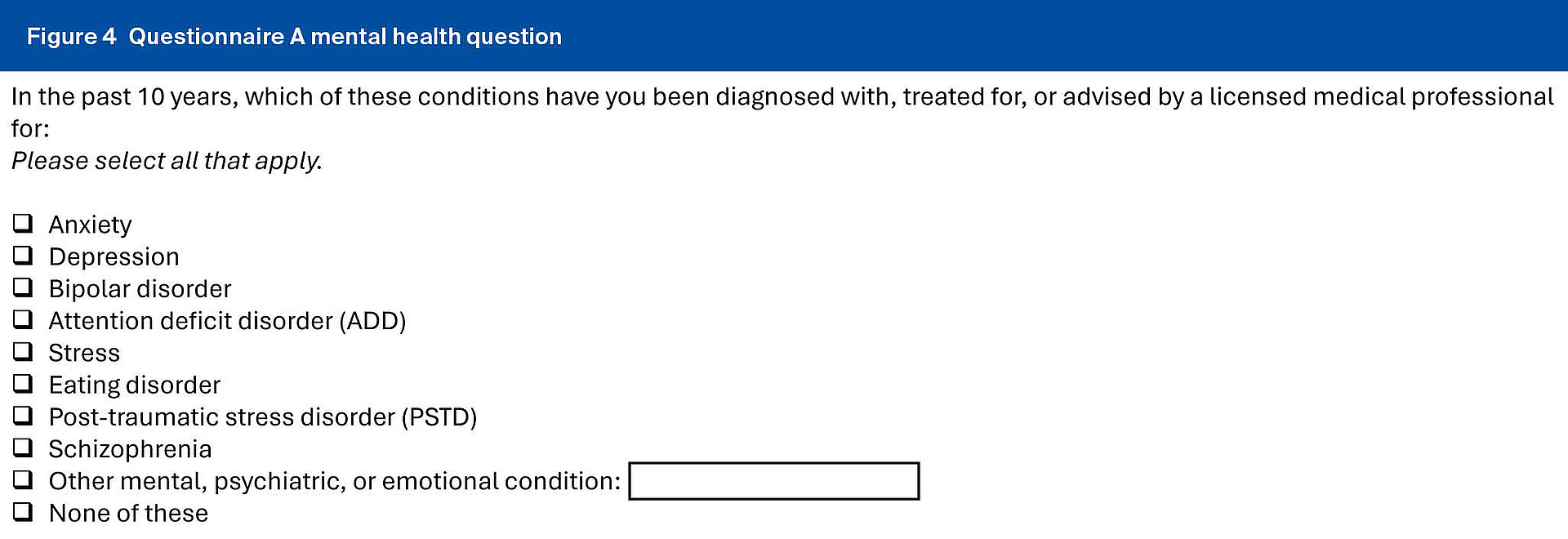

Questions that ask about conditions or behaviours associated with social stigmas can be especially difficult for applicants to answer honestly. This problem is amplified in many instances by the common practice of asking about multiple conditions/behaviours in the same question, with one Yes/No answer required for all of them. For instance, Figure 3 shows the wording of the control question on mental health, which mimics the format common in many application forms. From this list, certain mental health conditions are more severe and more highly stigmatized than others. This means that someone who has anxiety or depression may hesitate to be included in the same category as those who have bipolar disorder or schizophrenia. They may feel like the question does not fully apply to them, and they may answer “No” in order to avoid answering “Yes” to the conditions that they do not have. To overcome this tendency, Questionnaire A changed the format of the mental health question to ask about one thing at a time (see Figure 4 below). The mental health conditions were presented in a checkbox format, so that the participant only had to select the conditions that applied to them.

Making this simple change had a significant impact on disclosure rates. 36% of participants in the control group disclosed a mental health condition, while the rate was 52% for participants who saw questionnaire A. Analysis of the conditions disclosed supports the theory that the increase is due mainly to participants with less stigmatized conditions feeling more comfortable disclosing under a checkbox format. The largest increase in disclosures between the control and questionnaire A groups was for relatively socially-accepted conditions, such as stress.

Figure 3 Control mental health question

Figure 4 Questionnaire A mental health question

Finding #2: Social norms can be incorporated by assuming the behaviour exists, leading to increased disclosure.

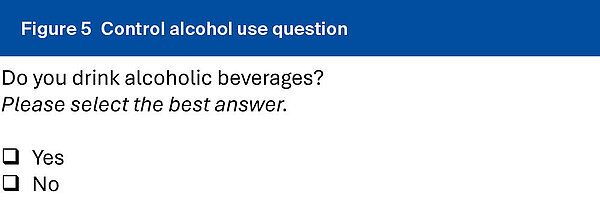

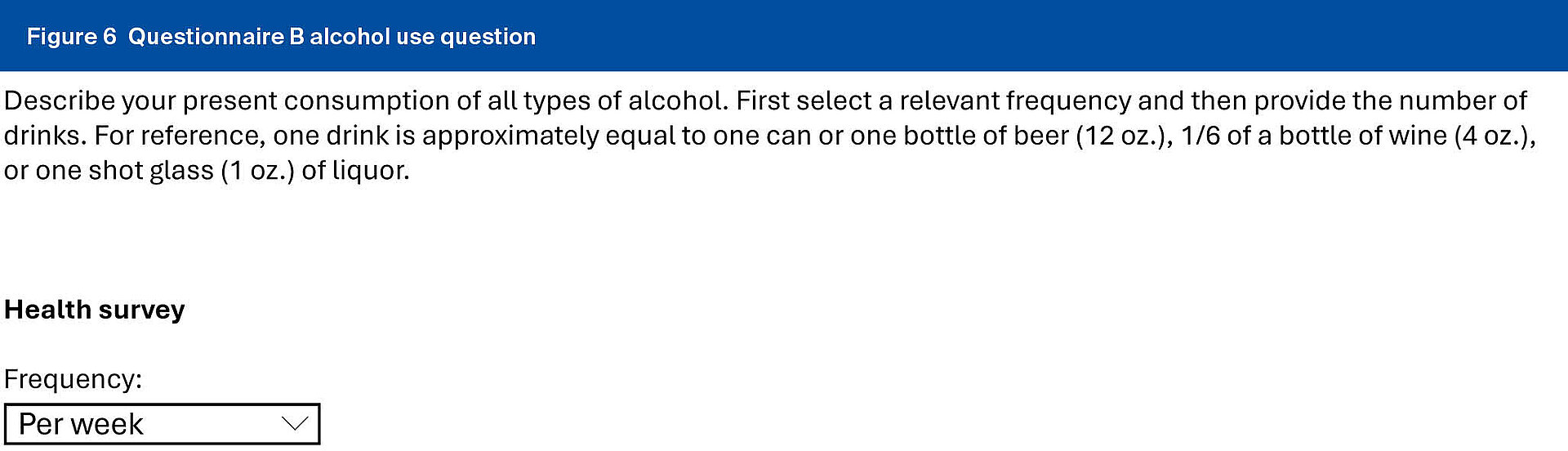

Social norms can also be incorporated directly into the application to reassure applicants and help them feel comfortable disclosing their behaviour. One way of doing this is to word the question to assume as a default that the behaviour exists, instead of using a simple Yes/No format. The difference can be seen in the wording of the control and questionnaire B versions of the alcohol use question (see Figures 5 and 6).

Participants answering questionnaire B still have the option to select “I do not drink any type of alcohol”, but, by assuming as a default that they do drink alcohol, the wording of the question portrays this as the expected, normal behaviour. This communicates a social norm, facilitating that participants can be comfortable disclosing their alcohol use. This technique appears to have been effective in increasing disclosure – 76% of participants in the questionnaire B group disclosed some alcohol use, compared to 66% of participants in the control group.

Figure 6 Questionnaire B alcohol use question

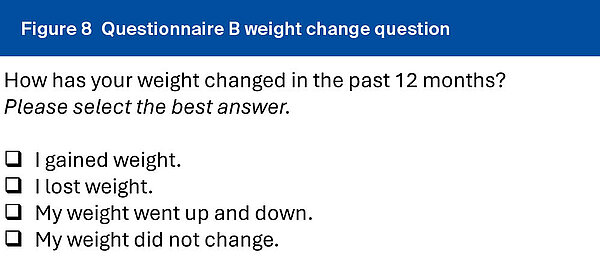

Finding #3: The flow and specific options of each question should be designed carefully to properly capture the different experiences of as many applicants as possible.

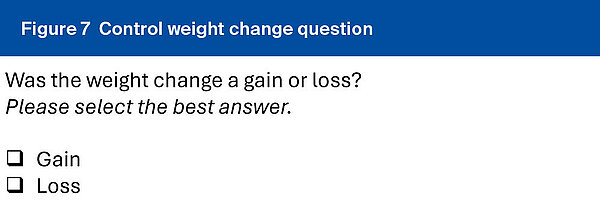

Questions designed with the most common answers in mind may leave applicants who fall outside of this norm unsure of how to answer, and that may lead to them skipping the question entirely or giving unhelpful answers. One example of such a question is the weight change question in Figure 7, where, traditionally, only two options are offered.

However, many people find that their weight fluctuates throughout the year – how then would they answer this question? Questionnaire B offers the option of “My weight went up and down” to capture the experience of these participants. This option proved to be relevant to a significant subset of participants – 24% of participants chose this option when it was offered.

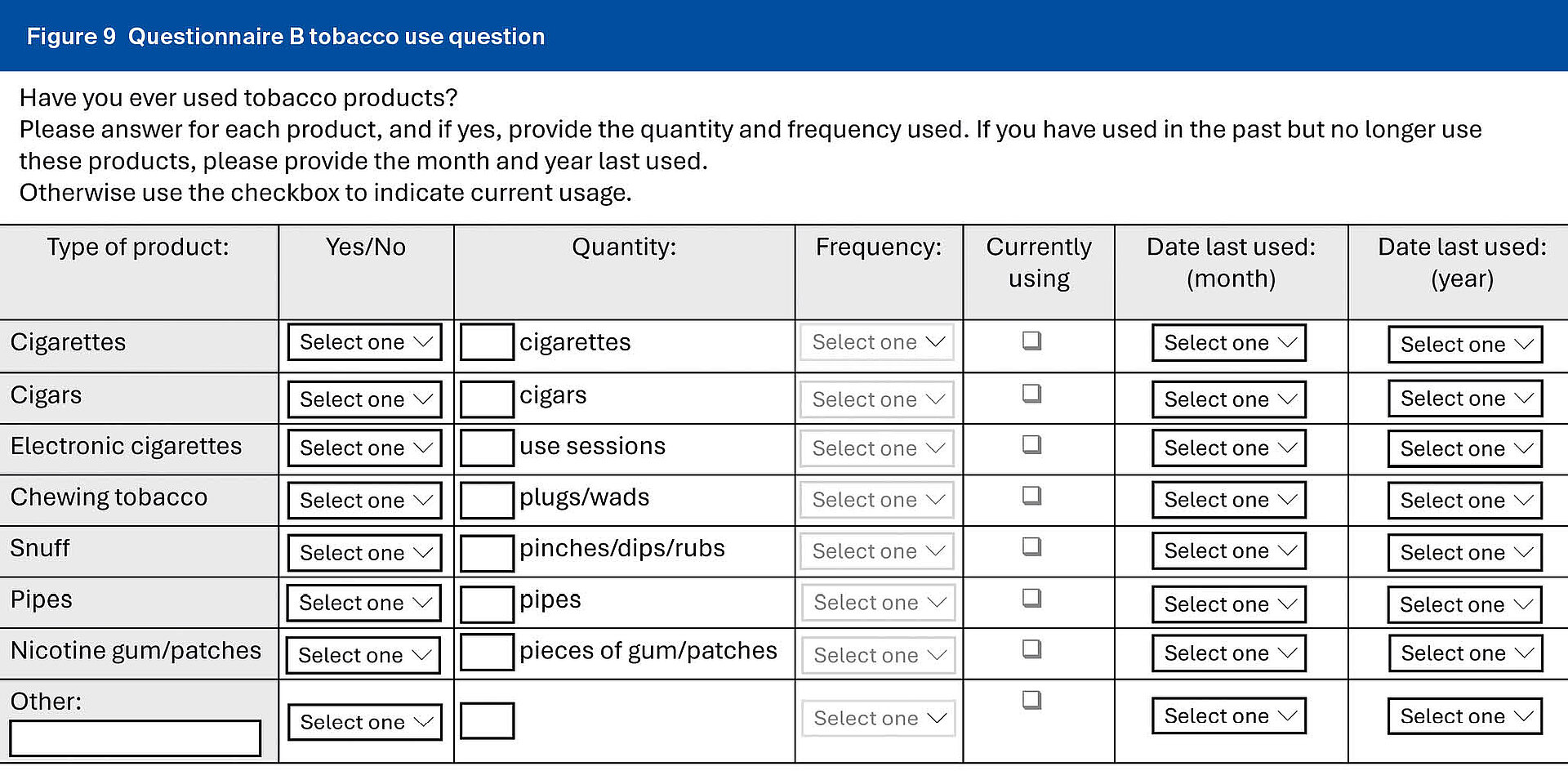

Another area where adding additional options can be helpful is in questions around consumption, particularly alcohol and tobacco use, where different individuals can have different combinations of frequency, amount, and products. However, this raises a potential concern when attempting to include enough options to be relevant to all applicants – making the question too complicated can lead to cognitive overload and leave applicants frustrated and overwhelmed. This can be seen in Figure 9 below, showing the Questionnaire B tobacco use question:

Figure 9 Questionnaire B tobacco use question

This format presents all of the options at once, and it led to no increase in disclosure compared to the control. However, questionnaire A shows a better way to organize several sets of options. In this format, participants were first asked to select the tobacco products they had used from a checkbox list, then asked to indicate (for each product separately) the frequency of their use. Finally, they were

presented with lists of their selected products divided by frequency and asked to provide the amount of each product they used.

Each of these steps was presented on a different page, so that no one page ever became overly cluttered or overwhelming. By using this reflexive logic, it was possible to incorporate a wide range of options without sacrificing comprehensibility. This approach may be longer in absolute terms than the one-page format used in questionnaire B. However, in terms of cognitive effort, this guided, step-bystep approach may actually be easier and less frustrating to complete, improving disclosure. This is reflected in the results – questionnaire A showed an increase in current tobacco use disclosures of around 20% compared to the control. Many US companies cite tobacco non-disclosure as one of the most material causes of misclassification; therefore, focusing behavioural re-design in this area may be of particular value.

Finding #4: Asking a confirmation question about certain important medical conditions can counteract skimming and improve recall.

On most traditional insurance application forms, medical conditions are grouped into lists by body system and then these lists are presented one after the other on the same page with a Yes/No response required for each. This format can easily become overwhelming for applicants, leading to skimming and reflexively checking “No” for each list to get through the information quickly.

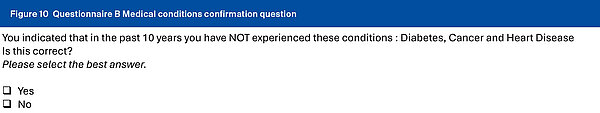

To counteract this tendency, questionnaire B used a confirmation question (see Figure 10). After completing the same long lists of medical conditions in the control form, participants who had not disclosed diabetes, heart disease, and/or cancer were asked to confirm that they did not have the conditions they hadn’t disclosed. The impact of this question can be seen by comparing the number of participants who disclosed these conditions the first time they were asked to the number of additional participants who disclosed them in the confirmation question. For each condition, the confirmation question increased disclosure by between 50% and 120%.

Finding #5: To help reduce non-disclosure, honesty pledges should be included at the beginning of the application.

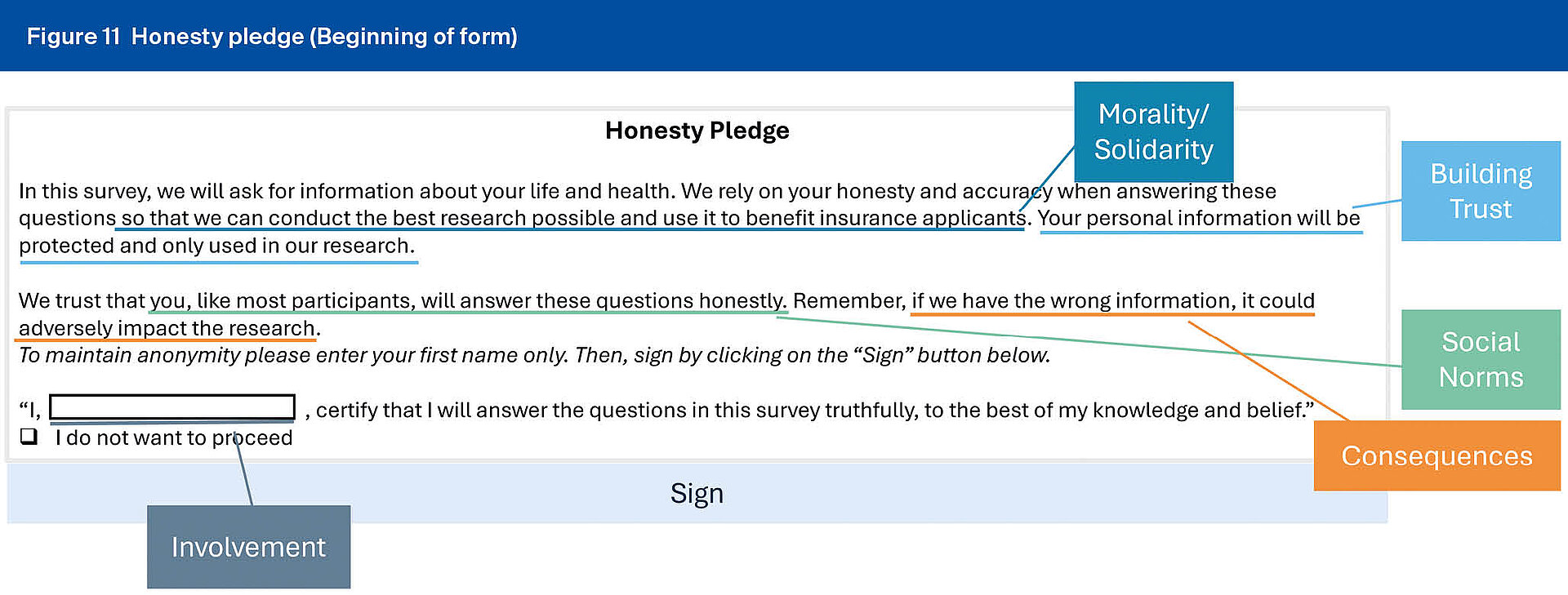

As mentioned previously, two groups of participants were selected to explore the impact of honesty pledges – short statements often included in application forms where an applicant has to sign to promise that their answers are true and complete. Honesty pledges are often buried at the end of the form, in the middle of the terms and conditions, and can contain technical or legal jargon – all of which can limit their effectiveness at increasing honest disclosure.

This study tested the impact of a behaviourally optimized honesty pledge, which incorporated various behavioural science principles (see Figure 11 below). Since this honesty pledge was written specifically for the experiment, the exact wording would not be used in a real-life application form, but similar principles could be incorporated.

For one group of participants, this pledge was attached to the beginning of questionnaire B, and participants had to sign to begin completing the form. In the other group, the pledge was placed at the end of questionnaire B. Participants were given the option to change any of their answers before signing the pledge and completing the form. The first and clearest finding from this part of the study is that in order to have any effect, the honesty pledge should be placed at the beginning of the application form. Among participants who saw the pledge at the end of the form, only around 1% went back to change any of their answers – exactly the same percentage as in all of the other groups, who saw the pledge at the beginning of the form or not at all. It appears that by the time participants had finished completing the form, they were not motivated to take the time to change any answers – and the honesty pledge did not change this.

When the pledge was placed at the beginning of the form, it did appear to increase disclosure on certain questions. For instance, the increase in disclosure from questionnaire B alone compared to the control on the mental health question was only around 10%, while the disclosure rate for the group that saw the honesty pledge at the start of questionnaire B was 25% higher than the control group.

In similar ways, the addition of the honesty pledge at the beginning of questionnaire B increased disclosure (when questionnaire B alone did not) of cancer and high-risk obesity.

This shows the potential of honesty pledges – but only if they are well-designed and placed at the beginning of the process to attract attention and put applicants in the right frame of mind as they start the application.

Figure 11 Honesty pledge (Beginning of form)

Next Steps

Behavioural science can be a powerful tool to increase honest disclosure on application forms. Our online experiment has clearly shown the potential of behavioural science techniques in theory. In our next phase of research, the Behavioural Science Team at SCOR will partner with an insurance company and test these ideas in the real world, with real insurance applicants.

When it comes to real-world testing, running a simultaneous test of two different application forms carries several regulatory and logistical challenges. Therefore, it is likely that we will instead pursue a before/after test. In this test, we will gather data on applicant outcomes under the current form in use at the client company – this will include disclosure rates, non-disclosure rates, percentage of applications accepted at standard rates, claims disputes, and applicant demographics.

Then we will redesign the application form, working hand-in-hand with our partner company to understand their needs and incorporate behavioural science principles. After the new form is implemented, we will gather data on the same measures as we did under the old form. Finally, we will compare the data from before and after the change in forms, revealing the impact of the behavioural science redesign.

We are currently seeking a partner company to work with us on this exciting next step in this research. If you think your company would be interested in partnering with us to further explore this topic, please reach out to one of the authors. To read the full report of our behavioural science experiment and view the interactive results dashboard, please visit: www.soa.org/resources/research-reports/2024/redesign-life-ins-underwriting/

https://www.soa.org/resources/research-reports/ 2024/ redesign-life-ins-underwriting/